11 STEPS TO BUYING A HOUSE: THE HOME BUYER'S ULTIMATE GUIDE TO BUYING A HOUSE IN TENNESSEE

Reliant Realty ERA Powered Team – Thursday August 31, 2017

Screw It. Let's Do It!

— Sir Richard Branson

So, you want to buy a house in Middle Tennessee.

Buying a house is the major purchase most of us will ever make in our lives.

It’s important to recognize that unlike shopping for anything else, buying a home is a multi-step process. In fact, it’s not a stretch to compare your decision to buy a house to a decision to take a journey. Think about it: you’re on the road to homeownership!

Be sure your home buying experience is an exciting adventure and not a twisting road trip full of wrong turns and roadblocks.

When buying your home, like with any journey, there’s a shortest distance from point A to point B.

To get on that most efficient path requires planning your route. Take the time to learn about and understand all the steps you need to take from your decision to buy a house right through to moving into your new home.

If this is your first journey to home ownership the road will be completely new. If it’s your second or third trip on the road to buying a home, you’ll likely find that things have changed since your last time out. So it’s important to know what you need to do to prepare yourself and what mile markers you should look out for.

Fortunately, we’ve got your back! Below we’ve outlined what those steps are, what to do to prepare yourself, and what to expect. So, let’s hit the road!

Home is not a place. It's a Feeling.

STEP 1

Getting Ready: Before You Search for a House, Research.

Before you even start looking at real estate listings, you have to know how much home you’re in the market to buy.

This means you have to get a clear picture of your financial situation. Having answers to these questions means you’ll be prepared when the mortgage processor is ready for your application:

- What’s your income range?

- What are your monthly expenses?

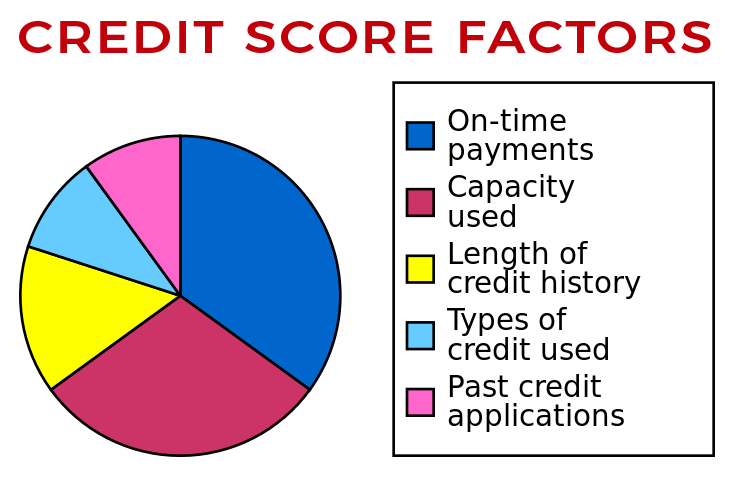

- Do you know what your FICO credit score is?

While lenders make their money by lending it, their first priority is minimizing their risk. When you ask a lender for pre-approval they look at your credit history to evaluate how big a default a risk you represent.

Is your credit history ready for a good once over by a lender or do you need to correct past credit issues to improve your credit profile?

Your credit history score is very important - it's how lenders decide how likely you are to default on your mortgage payments and what they use to assign you a credit-risk rating.

If you’re considered high-risk, you may have to look beyond traditional lenders like banks and co-ops and instead look at lenders willing to lend to a higher-risk borrower. However, a lender accepting a higher credit-risk comes at a price: you'll have to pay higher interest rates.

Higher interest rates mean that you'll be paying more to borrow the same amount of money. This means that higher interest rates could impact how much you can borrow while staying within the acceptable amount of income that should go to paying for housing.

How much is an acceptable amount? The general benchmark is 30% of gross household income.

It can be tempting to set aside more, but staying within this target will allow you the wiggle room you’ll need for unexpected expenses and to save for other life expenses such as retirement or your children’s education.

Now that you've got a number in mind, the next step is to get pre-qualified for a mortgage.

STEP 2

Getting Pre-Qualified. (Not Pre-Approved. Yes, There's a Difference)

Every business has a language; the world of real estate is no different.

You may hear or read online about getting "pre-qualified" for a mortgage. Then turn around and hear someone talk about being "pre-approved" and wonder if there's a difference.

There is: "pre-qualified" and "pre-approved" for a mortgage aren’t interchangeable terms. Instead, like the difference between a promise ring and an engagement ring, the level of commitment from a lender to lending you money is the difference between a maybe and a sure thing.

To begin, pre-qualified and pre-approved - in that order - refer to the first two steps involved in getting a mortgage.

Let's look at what each step requires from you and what each milestone means in your journey to home ownership.

Pre-Qualified for a Mortgage: Your First Stop

To get pre-qualified for a mortgage, you supply a lender with your overall financial picture including information about your income, assets, and debts.

Pre-qualifying - which can be done over the phone or online at no cost - is more of an informal first inquiry with a lender.

Its purpose is to give you a general idea of what mortgage amount a lender estimates you qualify for.

However, because the assessment doesn’t take an in-depth look at your finances and credit rating whatever amount you’re quoted should be taken as a general guideline.

Why? Because this step doesn’t involve a thorough financial assessment and credit check, the lender can’t form a complete picture of your potential default risk. This means that the amount you are pre-qualified for isn’t necessarily what the loan amount you can count on getting

Bottomline with pre-qualification is that the amount you are pre-qualified for isn’t necessarily how much money you can count on getting as a loan.

However, a real benefit from getting pre-qualified is that it will give you a good sense of the size of mortgage you can expect to qualify for and can function as a reality check, making sure you know how much house you're really in the market to afford.

The lender can also provide you with information about what mortgage options are available to you and what type of mortgage they would recommend based on your overall situation.

STEP 3

Getting Pre-Approved: Your Ticket to Ride!

Okay, you're pre-qualified. You've likely gotten assessments from a few lenders and have a sense of what you can afford and what interest rate you're mostly looking at for your mortgage.

Once you select the lender you want to work with, comes pre-approval. Engagement ring time: you're ready to ask for a commitment!

Pre-Approval: Step-by-Step

In the pre-approval stage, you complete and submit an official mortgage application to the lender (at a fee) and provide full documentation on your finances.

This is the point when a lender will perform a complete financial background check including taking a close look at your current credit rating.

Once done, the lender will give you the specific mortgage amount they will approve you for and at what interest rate.

Specifically, during the pre-approval process your lender will discuss:

- Down Payment options – several different options are available for financing. Some lenders can offer as little as 0% down. Be honest with yourself and properly identify the loan that is best for your monthly cash flow.

- Term options (15-year mortgage, 30-year mortgage)

- Interest rate locks – You will be able to lock in the interest rate of your choosing based on what interest rates the current financial market is driving. Listen to your lender and watch the market. You can save yourself money each month by locking in a lower interest.

Your monthly payment and how it will be applied to your outstanding loan amount. The lender will break down your payment as:

- Principal – applied directly to mortgage balance

- Interest – This is the percent you will pay for borrowing the money and will be impacted by the interest rate locked.

- Mortgage Insurance – your loan may require mortgage insurance if you finance more than 80% of the purchase price. This amount may be removed from your loan once you have 20% equity in the property (consult your lender).

- Property Taxes – Most people escrow the property taxes and have their mortgage company submit these taxes annually. This helps with establishing a monthly budget within your mortgage payment so you aren’t surprised by a $2,000+ bill at year end for your property taxes. Most property tax records are online so you can obtain a real figure to budget for this monthly cost prior to submitting the offer.

- Home Owner’s Insurance – Consult with a trusted insurance representative to obtain a quote on your new home. Typically, if you use the same agent who may carry other insurance for you (auto, life, etc), you may receive a discount.

- HOA – Homeowner’s Association Fees – (If applicable) These fees can run from under a hundred to several hundred dollars a month and need to be figured into the budget and loan approval. Check the HOA guidelines and by laws as well to be sure compliance will not be an issue for you.

The lender will also provide you a written conditional commitment for your exact loan amount.

Knowing how much you’re pre-approved for and having this conditional commitment in hand will give you the confidence of knowing exactly how much home you can afford and guide you and your agent in selecting properties to consider.

Then, when you find a property you want to make an offer on, it will provide you an advantage over other potential buyers who don't have pre-approval: you can make an offer that isn’t contingent on obtaining financing.

In a competitive housing market, this assurance of your seriousness and ability to close is an added benefit when sellers are considering multiple offers.

STEP 4

Looking for Properties: Head Out on the Highway!

Once you’ve been pre-approved and know your budget, it’s time to start looking at listings.

Take a look at what’s out there and understand what the market has to offer in your price range.

Timing and location are very important in real estate. Owning our own home is a goal we all have, but being sure you can comfortably afford the home you want, in the neighborhood you love, transforms your house into a home.

Being tied to the idea of buying a home, when the house you want is a financial stretch, isn’t a good idea.

Don’t count on your lender to advise you of the mortgage payment you can comfortably afford. Ultimately, their revenue depends on maximizing your loan amount, while minimizing their risk.

The smart buyer, like you, understands what their upper mortgage limit is and sticks to it. Once you get out there and start looking at properties, it’s easy to convince yourself that you can buy more house than you can comfortably afford. Resist that temptation.

Revise your expectations, or defer until you can afford more by saving a little longer and grow your deposit. The market might even move in your favour.

STEP 5

Selecting a Buyer's Agent: Don't Get Lost — Travel with a Guide

Once you understand how much you can afford, it’s time to find a real estate agent.

Working with a Buyer’s Agent is one of the best deals you’ll ever get. You’ll have a licensed professional working with you daily, to secure your best interests are met. Best of all, it doesn’t cost you anything.

Buyer’s agent commissions are taken out of the commission paid to the Seller’s agent. When an agent signs-on to represent you as the buyer, a relationship of trust is formed. The agent is responsible for offering you advice on your journey to purchasing a house and helps you negotiate the best deal on your dream home.

You’ll work closely with your agent, so find someone you’re comfortable with and build trust. To make sure you find the agent you need, read the article on the 3 C’s of Finding the Best Real Estate Agent For You.

How to Choose a Real Estate Agent

By Reliant Realty ERA Powered Team

STEP 6

Selecting a Title and Escrow Company: Growing Your Entourage

The crew that helps you find and buy your house includes not only your agent and lender but the teams at your title & escrow company.

Think of the title and escrow company as the air traffic controller that makes sure nothing gets in the way of a safe flight.

Their job is to clear the title to the house you are buying to ensure any liens or debts are paid by the seller before passing a clear title over to you.

The title company delivers a Commitment Letter to you detailing the legal property description and any issues they found with the current title (if applicable).

The title and escrow company also handles receipts and disbursement of funds for the transaction.

Who you use to manage the title and escrow for your deal is extremely important. They should have a solid reputation and be experts in title and deed issues.

You can specify who you want to use for title and escrow on your loan, so ask friends & family, or your real estate agent for a recommendation.

Signature Title Services

The most important step in closing a real estate transaction is title transfer. Visit Signature Title Services' "Title Services" information page for a primer on how the process works.

Multiple Offer Situation: How do You Win the Race?

When you find yourself in the middle of a multiple offer situation, your realtor will help your offer rise to the top to become the one accepted offer.

- Earnest Money – Earnest money is consideration for the contract. You are offering the earnest money as a show of good faith. Remember, the higher you offer in terms of earnest money (which ultimately applies to how much you have to bring to the closing table), the more commitment you display to the seller. Earnest money comes back to you by way of a deposit made by you on the closing documents and reduces your cash to close on closing day. So unless you plan to breach the contract, your earnest money is a safe bet. Offer roughly 1% of the purchase price to show the seller you are committed.

- If you can stomach the expense to make/manage most simple repairs, you can buy the house “as is” with a home inspection contingency. That way, if the needed repairs uncovered during inspections are more money than you are willing to take on, you can still back out of the contract due to the home inspection contingency and you will recover your earnest money. However, buying “as is” lets the seller know you aren’t planning to negotiate that they make any repairs prior to possession/occupancy. Review the property disclosures carefully prior to making your offer to see if the seller has any existing knowledge of potential issues.

- Include your pre-approval letter from your lender.

- Write a letter to the sellers. Compliment the home. Have your lender and/or real estate agent write a reference letter on your behalf.

If, ultimately, yours isn't the winning offer in a bidding war, console yourself with the Dalai Lama's words of wisdom: "Remember that not getting what you want is sometimes a wonderful stroke of luck."

Remember that

Not Getting What You Want

Is Sometimes

A Wonderful Stroke of Luck

— Dalai Lama

STEP 7

Your Offer was Accepted – Now What?

The seller said yes, so it’s time to do some homework and know what you’re getting into. In fact, it’s not just you who wants to know, but your lender does too.

You’re going to need a home inspection. The home inspection uncovers any hidden problems with the house.

If the house you’re set to buy is a sugar coated money pit that’ll bleed your wallet dry before you’ve had a chance to move in, you need to know. Your lender will also want any problems uncovered during inspections fixed before they hand over your loan or will require that the purchase price is amended to account for the cost of repairs.

When the seller accepts your contract, the inspection period starts. The inspection period is the time frame in which you are required to complete any/all inspections on the home.

Check your contract for these dates and check with your realtor. Line up as many inspections as you want and have them done! These can include:

- General Home Inspection

- Septic Inspection

- Termite Inspection

- Structural Inspection by a structural engineer (if necessary)

- Radon (if necessary)

Inspections can cost north of $1,000 in total. Be prepared to pay out of pocket for these items directly to the service provider.

Again, you want to be sure your inspector is reputable and thorough. Tap into your network for recommendations.

STEP 8

Applying for the mortgage: Underwriting

You’ve been pre-qualified and pre-approved, but now you have to apply to actually get the mortgage. Your lender is going to request your financial records, so dust off those files.

What documents does a mortgage lender need from you with your application?

After acceptance and as you head into the underwriting period (the process of your lender issuing the funds to purchase the property) your lender will ask you for several items including:

- Pay stubs

- Tax Returns

- Bank Statements

- Retirement Statements

- Marriage/Divorce Decrees

- Any other similar documents that impact your financial situation

You’re going to have to account for any hidden monthly costs as well. For example:

- Does the property come with leased equipment? For example a fuel or septic tank?

- If you are outside the city limits, you may have to pay for your own waste/disposal service for trash pickup.

- Utilities – ask the sellers for the last three months’ worth of utility bills so you can better budget the real costs of maintaining the home.

- Pest Control Contract – check to see if the previous owner has a pest control agreement.

- Lawn Maintenance – see if you will be assuming a lawn maintenance contract.

STEP 9

Getting What You Pay For: The Appraisal

Your lender - as well as you - will want to know your property is worth what you’re paying. So the next step in getting your mortgage approved and your funds issued is property appraisal.

Your appraisal will be ordered upon final review/approval of your loan. The faster you provide your lender with the documents requested in step 5, the faster your appraisal gets ordered.

Be prepared for your appraisal to take up to 2/3 weeks or more. If the appraisal comes in below asking, consult with your realtor immediately.

Depending on the way the contract is written, the home must appraise for the contract price or you, as the buyer, will be required to bring those additional funds to closing (out of pocket) outside of your mortgage loan.

Your contract will stipulate the time period in which you have to notify the seller upon receipt of the appraisal if you wish to negotiate a reduced sales price (assuming your offer was made contingent upon the home appraising for the purchase price).

You will typically be out of pocket at least $300 for the appraisal.

STEP 10

Scheduling the Final Walk-Through & Move In Dates: Bringing it In!

All inspections are complete. The appraisal is complete. The mortgage has been approved. Now what? Congratulations! You are on your last lap to the closing table!

You are full steam ahead barring any unforeseen problems.

Now’s the time to schedule movers or call in those favors that friends and family owe you!

You’ll also want to transfer utilities to your name, effective on the date of possession/occupancy which should be detailed in your contract.

Next, as your closing date approaches, your realtor will schedule a final walk through of the property. You’ll have one final chance to view the property before signing the closing documents.

Once you have the “clearance-to-close” from your lender, the title and escrow company will tell you how much cash you need to bring to closing.

Check the title and escrow company’s policies as many require a wire transfer or cashier’s check for funds over a certain dollar amount.

STEP 11

Move In

You’ve done it: You’re a homeowner! Relax and enjoy yourself: You’re home.

If You Haven't Found it Yet,

Keep Looking

Don't Settle

As with all Matters of the Heart,

You'll Know When You Find it.

— Steve Jobs

CHECK OUT SOME OTHER POPULAR LINKS

Check out these other popular links

Additional Resources if You're Moving to Tennessee

Searching for a house can be both exciting and stressful. Here are online resources to help you plan your move.

- The Nashville Chamber of Commerce "Getting Established" page is a great resource for information on a variety of topics and is a great place to start.

- Department of Motor Vehicles instructions to re-register your out of state driver's license and vehicle.

- Check out the neighborhood! Read up on Nashville's eclectic neighborhoods and find your ideal vibe.

- Have kids? Learn about schools and their ratings before you move.